Business Insurance

Personal Insurance

80% of properties are underinsured*, and the estimated underinsurance total for all UK commercial properties is £340 billion**. So, it is crucial to make sure you are accurately covered.

WHAT IS UNDERINSURANCE?

Underinsurance is when the cover you have purchased is not enough to meet your business requirements in the event of a claim. Insuring assets for incorrect values or setting cover limits too low is likely to result in underinsurance.

One of the most important things to consider when taking out an insurance policy is just how much cover you actually need. If your cover isn’t adequate and you need to make a claim, you could end up paying a lot more than you anticipated.

There are many factors that affect whether a business has the right levels of cover in place or not. Inflation, supply chain challenges and the ongoing coronavirus pandemic are just some of the current things at play – individually they can have a huge impact but, combined are a perfect storm.

Covers and limits set even just 12 months ago can now be out of date, leaving businesses potentially exposed and vulnerable should they need to make a claim.

ARE YOU UNDERINSURED?

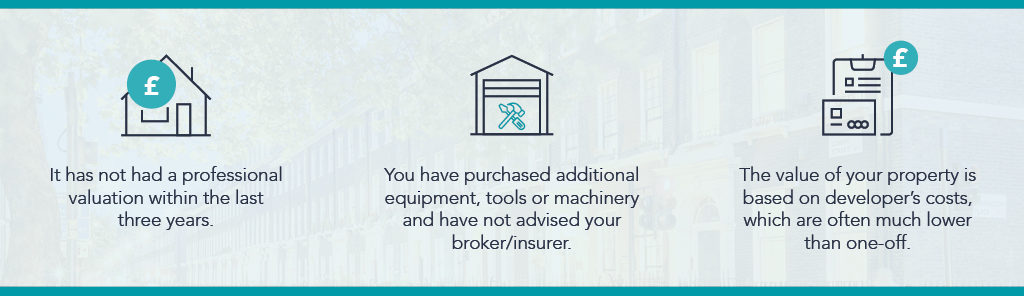

Below are just a few indicators that your building could be underinsured:

Additional indicators to be added

How confident are you that you have the right insurance in place to meet all your needs? For more information and advice on how to help protect you and your business from underinsurance, contact your usual broker or find a broker.

*Data from CPA Surveying Services 2021.

**Estimate based on British Property Federation (BPF) data on UK commercial real estate.